Traffic Light Trend Moving Average Strategy Metatrader 4 Forex Robot Review

This article discusses the Traffic Light Trend Moving Average Strategy Metatrader 4 Forex Robot. This trading strategy utilizes a combination of trend analysis and moving averages to make profitable trades in the foreign exchange market.

The Traffic Light Trend Moving Average Strategy Metatrader 4 Forex Robot is an automated trading system designed to identify trends and enter trades based on specific criteria. It uses three different moving averages, each with a unique color code (red, yellow, and green) that corresponds to its position relative to the current price.

Download Free Traffic Light Trend Moving Average Strategy Metatrader 4 Forex Robot

By analyzing these moving averages together, the robot can determine whether there is a strong uptrend or downtrend in place and initiate trades accordingly. The use of multiple moving averages provides greater accuracy than relying on just one indicator alone, making this strategy an effective tool for traders looking for consistent profits in forex markets.

Utilizing Multiple Moving Averages For Increased Accuracy

Moving averages are widely used in trading as they provide a simple and effective way to identify trends. By calculating the average price of an asset over a certain period, moving averages can help traders filter out noise and focus on the overall direction of the market.

However, using just one moving average may not be sufficient for accurate trend identification, especially when dealing with volatile markets. Utilizing multiple moving averages can increase accuracy by providing more information about the strength and direction of a trend.

Traders can use different combinations of short-term and long-term moving averages to optimize their settings based on their trading strategy and risk tolerance. For example, combining a 10-day exponential moving average (EMA) with a 50-day EMA can help traders identify short-term trends within a larger uptrend or downtrend.

Backtesting results have shown that utilizing multiple moving averages can improve profitability compared to using only one. This is because it helps reduce false signals and provides clearer entry and exit points for trades.

Additionally, incorporating other technical indicators such as momentum oscillators or volume indicators alongside multiple moving averages can further enhance the effectiveness of this strategy. Overall, utilizing multiple moving averages is a powerful tool that traders should consider incorporating into their trading plan for increased accuracy and profitability.

Identifying Trends With The Traffic Light Color System

The traffic light color system is a popular trend identification tool in forex trading. It works by using three colors to represent different market conditions: green for an uptrend, red for a downtrend, and yellow for a range-bound market. Traders can easily identify these trends by looking at the color of their charts.

To make the most out of this strategy, traders must learn how to use other technical indicators in conjunction with the traffic light color system. For example, they can combine moving averages or oscillators to confirm a trend change. By color coding these indicators based on the traffic light system, traders can quickly spot changes in market direction and adjust their trades accordingly.

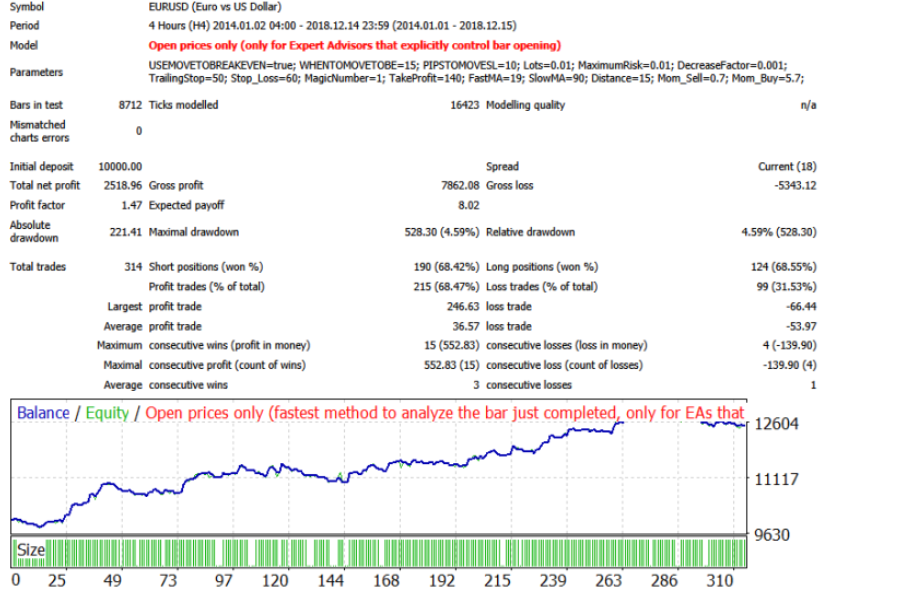

Before implementing any trading strategy, it’s crucial to backtest it first for historical accuracy. The traffic light trend moving average strategy is no exception. Backtesting involves analyzing past price data and simulating trades using that information. This process helps traders understand how effective their strategies are under different market conditions and whether they need adjustments before applying them in real-time trading scenarios.

Numeric List:

- Combining multiple technical indicators with the traffic light system increases its effectiveness.

- Using colored-coded indicators makes it easier to read price action trends.

- Backtesting is essential to determine if a particular trading strategy fits your risk tolerance level and profit goals.

- Historical accuracy provides insight into whether a specific approach performs well under varying market conditions.

In summary, identifying trends through the traffic light color system is an efficient way of determining market direction without getting lost in complex analysis tools. However, combining this method with other technical indicators enhances its reliability even further.

Always remember to test your strategies beforehand through backtesting to ensure historical accuracy and establish realistic expectations when executing trades live.

Automating Trades With The Metatrader 4 Forex Robot

Having identified trends with the traffic light color system, traders can now move on to automating their trades using the Metatrader 4 Forex Robot.

This robot allows for automated trading based on pre-set rules and strategies, including the use of moving averages to identify trend changes.

One popular strategy is the traffic light trend moving average strategy, which uses a combination of the traffic light color system and moving averages to determine when to enter or exit trades.

By analyzing backtesting results, traders can fine-tune this strategy and optimize it for maximum profitability.

However, it’s important to remember that no trading strategy is foolproof and risk management techniques must be employed at all times.

This includes setting stop-loss orders and limiting exposure to any single trade or currency pair.

With proper risk management in place, traders can use automation tools like the Metatrader 4 Forex Robot to execute their chosen strategies with precision and efficiency.

Conclusion

This article has explored a forex trading strategy that utilizes multiple moving averages and the traffic light color system to identify trends. By combining these two techniques, traders can increase their accuracy in predicting market movements.

Furthermore, by automating trades with the Metatrader 4 Forex Robot, traders can execute their strategies more efficiently and consistently.

Overall, this strategy presents an opportunity for traders to capitalize on trends in the forex market while minimizing risk. However, it is important to note that no trading strategy is foolproof and careful analysis of market conditions should always be conducted before executing any trades.

With proper implementation and monitoring, this trend-following approach may prove successful for forex traders seeking consistent profits over time.